tax credit survey mean

It asks for your SSN and if you are under 40. Online taxpayercustomer experience survey IRSgov Ongoing.

A Simple Guide To The R D Tax Credit Bench Accounting

Our company participates in a federal employment initiative called the Work Opportunity Tax Credit WOTC.

. After submitting your application you will be asked to complete the WOTC. Hiring certain qualified veterans for instance may result in a credit of. EMPLOYER WILL NOT SEE YOUR RESPONSES.

However if you have a 100 tax credit it will save you 100 in taxes. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid. The value of a tax credit depends on the nature of the credit.

Big companies want the tax credit and it might be a determining factor in selecting one applicant over another. I also thought that asking for a persons age was discriminatory. Becaue the questions asked on that survey are very private and frankly offensive.

Deductions reduce your taxable income while credits lower your tax liability. A WOTC tax credit survey includes WOTC screening questions to see if hiring a specific individual qualifies you for the credit. The amount of the credit is 100 of the first 2000 of qualified education expenses you paid for each eligible student and 25 of the next 2000 of qualified education expenses you paid for that student.

Pre-Hire During the Application Process If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process. To collect this information we surveyed 1431 businesses that claimed Minnesotas research tax credit in at least one of three recent tax years 2012 2013 or 2014. As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher.

Knowledgeable enough or properly equipped to file for credits or to file for them effectively enough to maximize whats available to them. Answer the questions and provide your e-signature. I dont just give anyone my SSN unless I am hired for a job or for credit.

A tax credit survey checks to see if the quality assurance service technical equipment including software systems databases and analytics works properly. Solved Examples- Input Tax Credit ITC Q1. We request that you complete the following survey to determine if our company may be eligible for tax credits based on our hiring practices.

A tax credit differs from deductions and exemptions which reduce taxable income rather than the taxpayers tax bill directly. Let me ask you I promise not to do anything bad with your SS want to post it on CD we know the answer already. For example Macys adds a tax credit survey to its application form to identify applicants who if hired qualify the company for the Work Opportunity Tax Credit.

A tax credit is a type of tax incentive that can reduce the amount of money a taxpayer owes the government. So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. To present your job-related skills and qualifications.

A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government. Completing a Tax Credit Survey Work Opportunity Tax Credit WOTC is a federal tax credit provided to employers for promoting the hiring of individuals from certain groups who might face barriers to fair employment. The input tax credit is not available for purchasing petroleum products liquor petrol diesel motor spirit etc.

The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they. You can possibly claim a credit equally to 26 percent of an employees pay if they work 400 hours or more during the tax year. Research Applied Analytics and Statistics RAAS Individual Taxpayer Burden Survey ITB 7312020 2018 Study Mail Online.

Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar. A tax credit lowers the amount of money you must pay the IRS. For example if youre the 22 tax bracket and you have a 100 deduction that deduction will save you 22 in taxes 22 of 100.

The Work Opportunity Tax Credit WOTC is a Federal tax credit incentive that Congress provides to employers for hiring individuals from certain target groups who have consistently faced barriers to employment. Tax Pro Account Survey. Also referred to as the AOTC the American Opportunity Tax Credit is for qualified education expenses you pay for yourself your spouse or your dependents.

Such transactions are called zero-rated transactions in GST. Internal data must be verified in order to ensure accurate data when filling out tax credit surveys. A tax credit differs from deductions and exemptions which reduce taxable income rather than the.

Thats what tax pros mean when they say tax credits are a. A tax credit survey is simply a questionnaire designed to identify job applicants covered by a tax incentive. Tax credit questions become part of the application and applicants view the extra 30 seconds to two minutes that are required to complete the hiring incentive questions as just another step in.

Opportunity Tax Credit WOTC the flagship federal program jointly managed by the IRS and Department of Labor. Survey Methodology s part of evaluating Minnesotas research tax credit we wanted a better understanding of businesses perspectives on the tax credit. A tax credit is a provision that reduces a taxpayers final tax bill dollar-for-dollar.

In exports of goodsservices GST is not payable but the input tax credit is still available. What Is a Tax Credit. That means that if you owe Uncle Sam 5000 a 2000 credit.

Of the government-funded hiring incentives the one with the highest visibility is Work.

Child Tax Credit Has Cut Food Hardship For 3 3 Million Families So Far

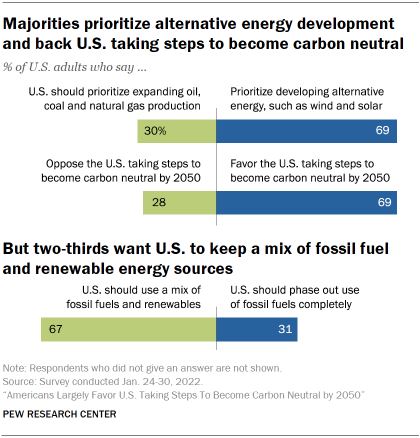

Americans Largely Favor U S Taking Steps To Become Carbon Neutral By 2050 Pew Research Center

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp

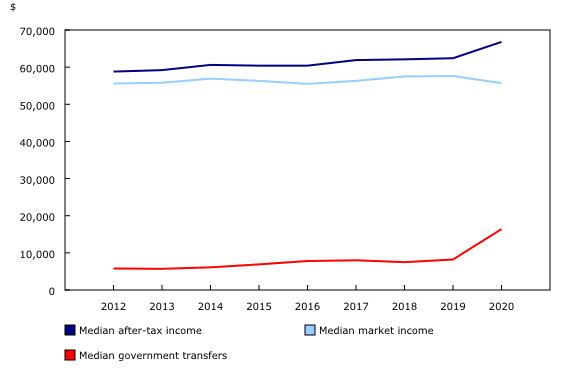

The Daily Canadian Income Survey 2020

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

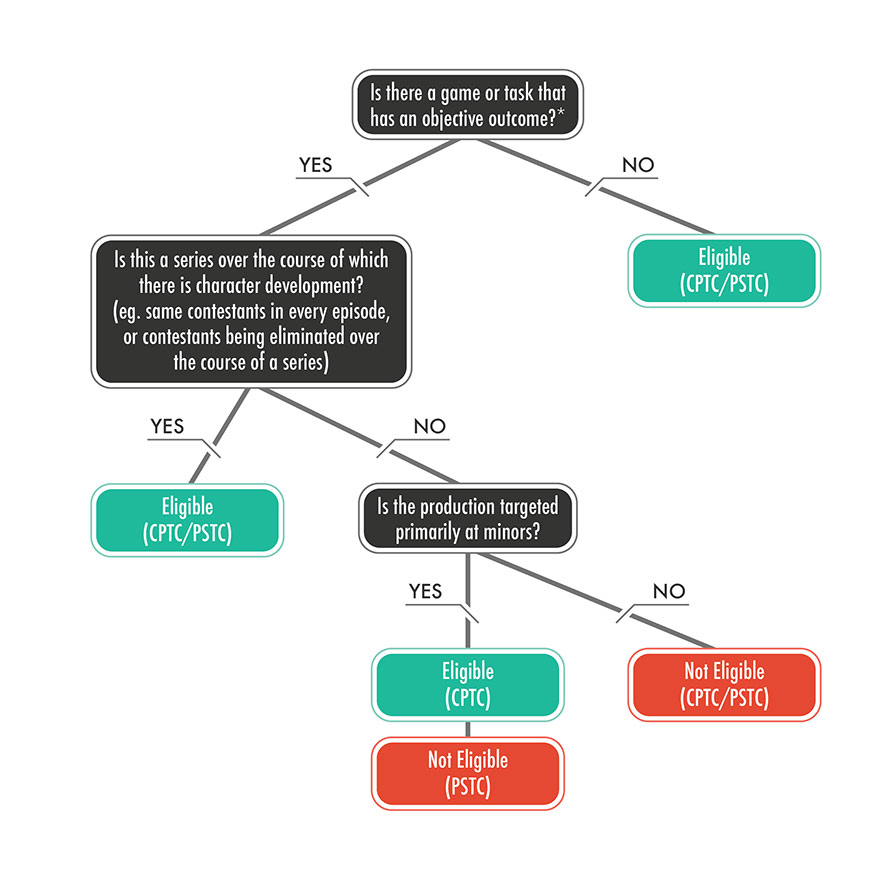

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

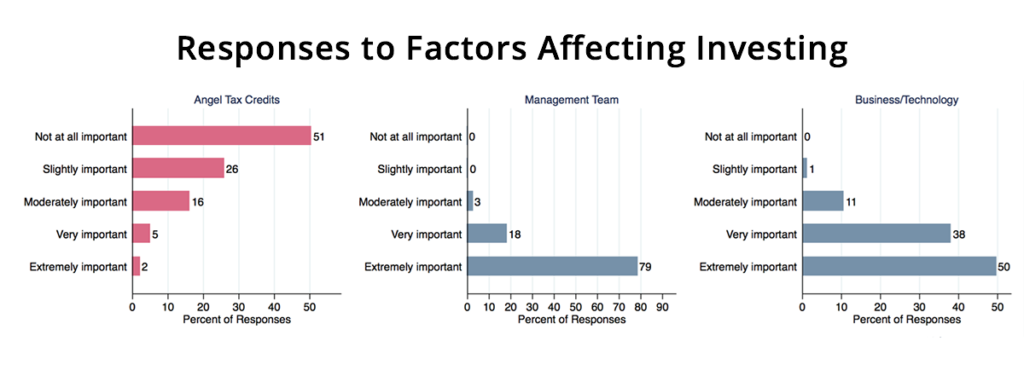

State Tax Credits For Angel Investors Backfire Ucla Anderson Review

Climate Action Incentive Payments Caip For 2022 How Much Will You Get Savvynewcanadians

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Digital News Subscription Tax Credit In Canada What You Need To Know Savvynewcanadians

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

The Basic Deemed Dividend Tax Rules Toronto Tax Lawyer

The Earliest Child Tax Credit Payments Meant 3 3 Million Households With Kids Had Enough To Eat

Application Guidelines Canadian Film Or Video Production Tax Credit Cptc Canada Ca

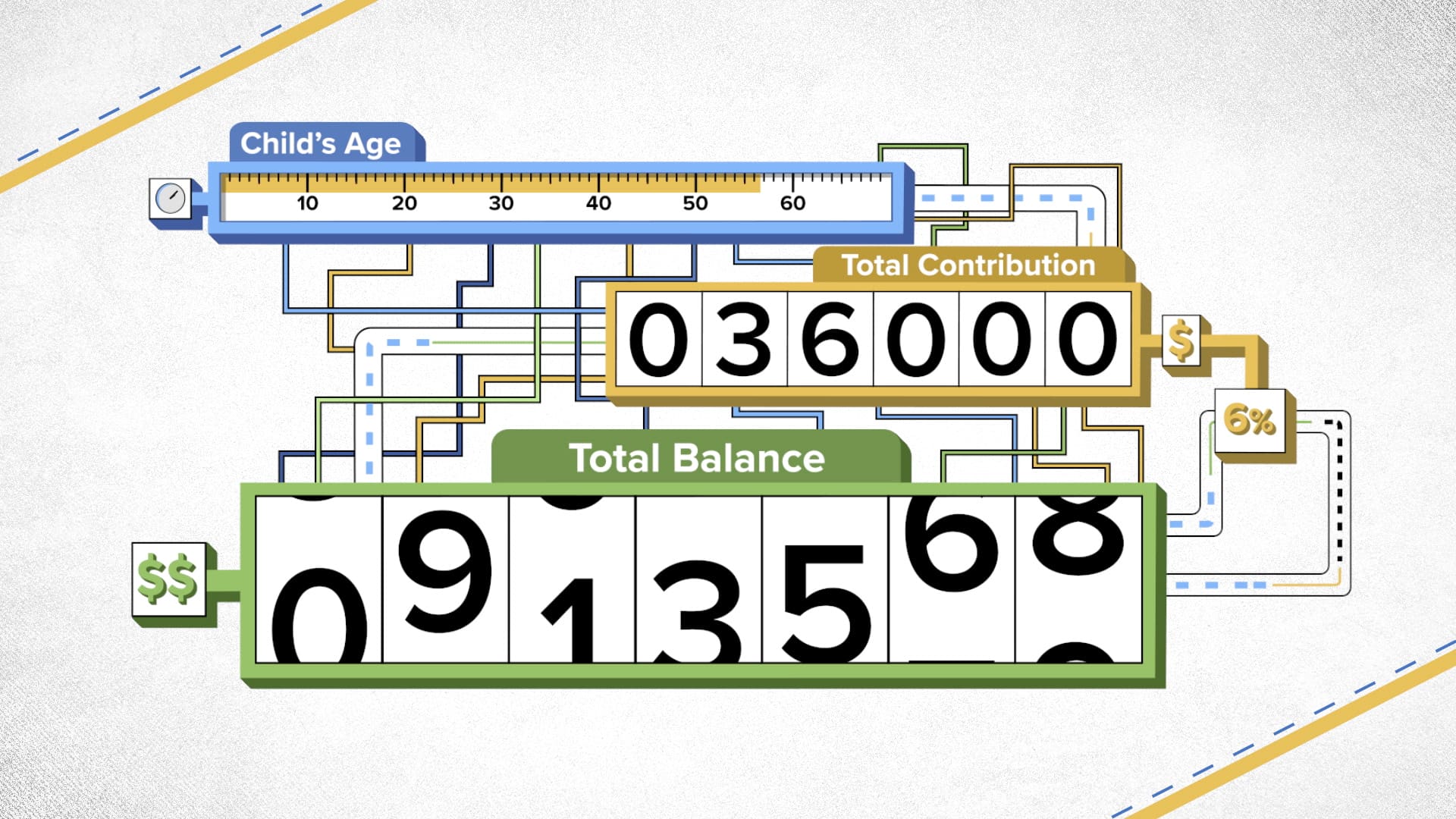

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/6520933/child_allowances_chart.jpeg)

Sweden Pays Parents For Having Kids And It Reaps Huge Benefits Why Doesn T The Us Vox

Digital News Subscription Tax Credit In Canada What You Need To Know Savvynewcanadians